Biggest Gambling Losses Uk

Nov 17, 2020 The age of gambling participants in the UK tends to be fairly high, with people between 45 and 64 years old showing the highest proportion of gambling participation. In 2018, there were 36.6. A BRITISH punter has lost $5million after betting on Donald Trump to defeat Joe Biden in the US presidential election. The former banker, who is based offshore, used a private bookies registered on.

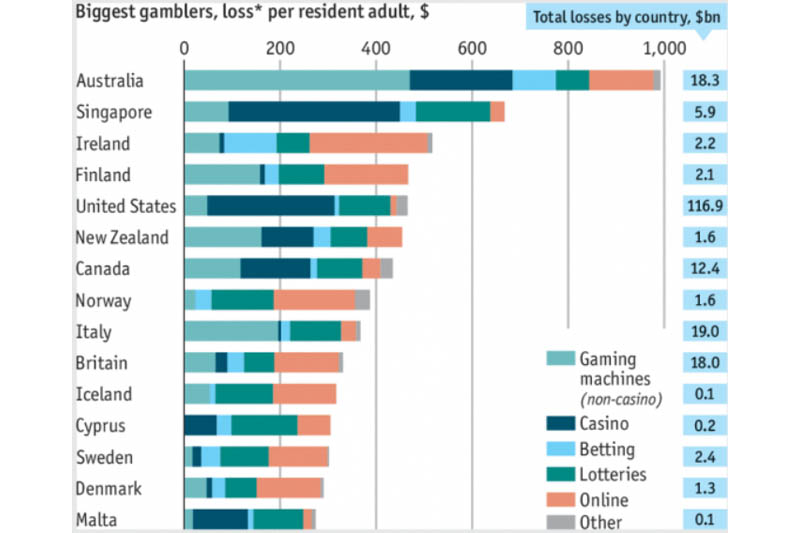

So, we thought it might be fun to take a look at the 5 leading countries when it comes to the biggest gambling losses on an annual level. Maybe you can already guess some of them? Or maybe even all? Well, in order for you to check whether you were right or wrong, you’ll just have to keep on reading.But before we list them off, we should explain that these 5 countries are the ‘world leaders’ in terms of both casino and non-casino gambling. Furthermore, the proliferation of the popular online gaming fad seems to be driving totals even higher! Let’s not keep you waiting any longer in revealing which countries we are talking about.

5. Rule, Britannia?

Well, when it comes to this topic, pretty much. Though it certainly isn’t the 1st on this list, rather takes 5th place, which is still ‘quite the achievement’. Its annual gambling losses estimate a total of no less than $19.9 billion! Once again, The Economist states that the annual average loss per adult is nothing short of 400 dollars. But in contrast to the other globe leaders when it comes to gambling, the UK appears to evenly split its wagers amongst a wide variety of gambling forms.

Would you believe that merely 10% of this is spent on your classic casinos? The rest goes out to non-casino gambling machines, lotteries, betting of all kinds, and, wouldn’t you know it, online gambling. So, it turns out that even though these Brits rather like testing their luck on a constant basis, they’re not exactly big fans of casino gaming.

4. Il Bel Paese

You may have heard of this lovely term (the beautiful land) being attributed to none other than Italy (it is in Italian, after all). This cradle of ancient civilization in the form of a boot totals its annual gambling losses at $23.9 billion! This means that, on average, an adult Italian loses no less than 450 dollars each year. And, yet again, the vast majority of Italian gambling occurs outside the casinos, mainly on non-casino gaming machines.

Though admittedly, lottery comes in second, albeit it’s a rather distant second. It appears that casino gambling is quite unpopular among the gambling residents of Italy. The Economist informs that the interactive online gambling outpaces its ‘casino cousin’, though just by a little.

3. Land of the Rising Sun

Coming in at third place, the Japanese take the bronze when it comes to annual gambling losses. These losses amount to a total of $31.4 billion every year. And yet surprisingly, regardless of this huge number, the average Japanese adult has a relatively low annual gambling loss. To be precise, no more than 300 dollars per year. And since casino gambling is officially considered illegal all across this land, is it any wonder that non-casino gambling machines are all the rage there?

This one particular pinball-flavored game, named ‘pachinko’, enjoys great popularity by the Japanese. Moreover, parlors don’t award cash, due to them trying to skirt the gambling regulations. This only means that the players need to go to a separate establishment, so they could sell the metal balls. Which metal balls, you ask?

You see, they serve as a makeshift type of currency when it comes to playing pachinko. In case you’re now thinking it sounds just a bit more complicated than necessary, we are here to tell you – you are absolutely right! Recently, however, the pressure on the lawmakers in Japan to ease these strict gambling restrictions has been rising. This is also largely due to the quick growth of China’s tourism industry.

And besides, South Korea has also greatly expanded when it comes to its casino industry, with several south-east Asian countries quickly following suit. So, if Japan follows through with its plan to build an integrated resort ‘a-la Singapore’ near its capital, Tokyo, then it may just flourish yet, and move up on the list soon enough.

2. Red is a Lucky Color!

Biggest Gambling Losses Uk Lottery

Or maybe it’s the cute and cuddly pandas, which have already made appearances in certain slot themes and whatnot. Though in all honesty, it may not exactly be all that lucky for gamblers living in China, as their estimated annual gambling losses total at $76 billion. No wonder it takes second place on this list! And although such a high number is indeed something to gawk at, we need to remember that China has the largest population in the world - 1.357 billion.

Though of course, not all are gamblers, but still. Despite this infamous second place, China does not belong to the top 20 countries when it comes to annual losses per resident. We mustn’t forget to mention the largest gambling city on the planet, Macau! But that’s not all, as you see, the Chinese government also appears to operate two lotteries. These are the China Welfare Lottery and the China Sports Lottery.

As far as unofficial lotteries, as well as other illegal gambling activities (card games and mahjong), back in 2010, an estimated 1 trillion Yuan (which would be about 154.68 million dollars) was reported. And since these were never accounted for in the official data collected, it may just be that China’s real annual gambling losses are much, much higher.

1. Good Ol’ US of A…

Is anyone truly shocked by this? After all, the United States is the ‘proud’ home of Sin City and many other casino destinations. Who doesn’t think of Las Vegas, whenever someone mentions gambling? It takes the gold here with an annual gambling loss totaling at around $119 billion. As if that wasn’t plenty, USA is also in the top 5 when it comes to annual gambling losses per resident – 500 dollars.

Once again, no big surprise, as there is no other folk out there who love their casino gambling as the Americans. Around 50% of these gambling losses occur on none other than the floors of their many casinos. And with such grand figures (enough to make one dizzy) it isn’t exactly a mystery why America’s large gambling industry thrives to this day.

And, for better or worse, new resorts are practically popping like daisies all across this vast county, which add to the competitive pressure Atlantic City (among others) has been feeling nowadays.

Conclusion

Well, were any of these a surprise for you? Maybe you were expecting to see some others instead? Whatever the case, now you know what’s what. And if you happen to be a citizen of one of these countries, now you have something more to ‘brag’ about your country being the leader in. And if you happen to be players yourselves, good luck to all of you no matter where you’re from!

Lottery Lovers’ Paradise

You’re an avid lottery player, but you don’t seem to be gaining much? That’s ok, especially if you live in the UK. The country is a heaven for lottery lovers, even if they aren’t particularly lucky. Why is that so? Two words – tax deductions.

Gambling losses in the UK are tax-deductible, hurray! Before starting to rub your hands together and make plans about all of the money you’re going to save on taxes, however, we need to warn you that there’s a twist (isn’t there always a one?). The gambling losses are deductible but to the extent of your winning.

Yep, it does sound a bit confusing. Maybe breaking it down and examining the details will shed some light on what has to happen for your gambling losses to lower your taxes and make you one happy camper.

Alright Kids Here’s How to Minimize Your Gambling Losses

2017 Gambling Losses

As already mentioned, these tax benefits apply to residents of the UK.

It’s nothing but logical that gambling winning will be added to your taxable income. When it comes to deducing losses from your taxes, things get to be a bit more complicated than that.

The first and the most important rule for monetizing your gambling losses is to keep accurate track of all activities. The activities that fall under such regulations include playing casino games, lotteries, raffles, and other types of gambling games. You may want to keep receipts for the fun and exciting time of the year known as tax season.

Anyone who has acquired gambling income during the year will have to fill out a gambling winnings form alongside the official tax statement. This form will also have to be filled out in the case that non-cash awards have been acquired (real estate, cars, appliances, etc.). You’ll need to list the fair market value (FMV) of the item – this is the selling price of each item. Finding the selling price could be a bit of a challenge, so you may want to consult a professional about listing your winnings.

But enough about the lucky people who’ve gotten money, cars, and boats. This article is dedicated to the losers. As it stands, the chances are that it addresses the vast majority of lottery players. Oh well, it wouldn’t be as fun if it were easy, wouldn’t it?

Now, here’s the tricky part – you can deduct your losses as an itemized deduction. You can’t take the amount you’ve lost out of the amount you’ve won and report the difference as your income. If it worked that way, the chances are that many people wouldn’t owe the government any taxes at all.

Also, keep in mind that gambling losses can’t be reported over the amount of your gambling winnings. If you’ve won 1,500 pounds during the year, for example, your gambling losses reported as an itemized deduction can’t exceed 1,500 pounds. Told you it was a bit tricky!

Since going through the documents and filling all of that information correctly may be a bit challenging, it’s always a good idea to have a professional do the job for you. Indeed, you’ll have to pay for the service, but it can save you a lot of money that you’ll otherwise have to spend in taxes because you didn’t make the right calculations.

Gambling Losses Tax Claims in the US?

So, how about doing what UK folks can do in the US? Is it possible to deduce gambling losses from taxation? Here’s what IRS has to say about the topic.

Biggest Gambling Losses Uk Trade

Just like in the case of being a lucky winner in the Kingdom, you’ll have to include your gambling winnings in your taxable income amount. According to the IRS website, raffle, lottery, horserace and casino winnings will all be subjected to taxes.

Gambling losses can be claimed but once again – only to the amount of the winnings. Just like in the UK, you can’t take the loss out of the amount you’ve won and declare only that amount as a taxable income.

To deduct gambling losses, you should have kept all the receipts, the losing tickets, statements, and any other documents that prove the amount you’ve spent on gambling activities and the amount you’ve lost. If you need any additional information about the proof you should have or the procedure enabling you to deduct gambling losses from your taxes, you can call 800-TAX-FORM (800-829-3676).

Big Brother’s Watching You?

By this point, you may be thinking that we’re nuts. After all, lotteries are cash businesses and a governmental entity like the IRS in the US will have no way of knowing just how much you’ve won and lost during the year. Is there any point of declaring winnings and losses whatsoever? Isn’t it better to keep it quiet and avoid taxation?

Unfortunately, it doesn’t work this way.

Gambling establishments in the US and the UK are expected to provide governmental agencies information about winnings that exceed a certain amount.

In the US, this amount is 1,200 dollars for casino wins, and 1,500 for lottery wins. If this income isn’t listed on the tax return, the chances are that you’re going to get in trouble. Still, if you’re an avid lottery fan, the chances are that you have at least some losses that will counterbalance the taxable income and decrease the amount of money you’ll have to give the state.

Biggest Gambling Losses In The World

Once again, we’ll encourage you strongly to find a taxation expert that specializes in gambling losses and winnings before filling out those forms. A small mistake could get you in trouble!

And a final thing – if you’re a classified as a professional gambler, the rules will be different for you. Only a few individuals will qualify as professional gamblers, and these individuals are usually subjected to more lenient taxation procedures. Bummer!